Insights

Competing in a Spoiled Market: The Reality of Running a True A-Book Brokerage in an Industry Built on Illusions

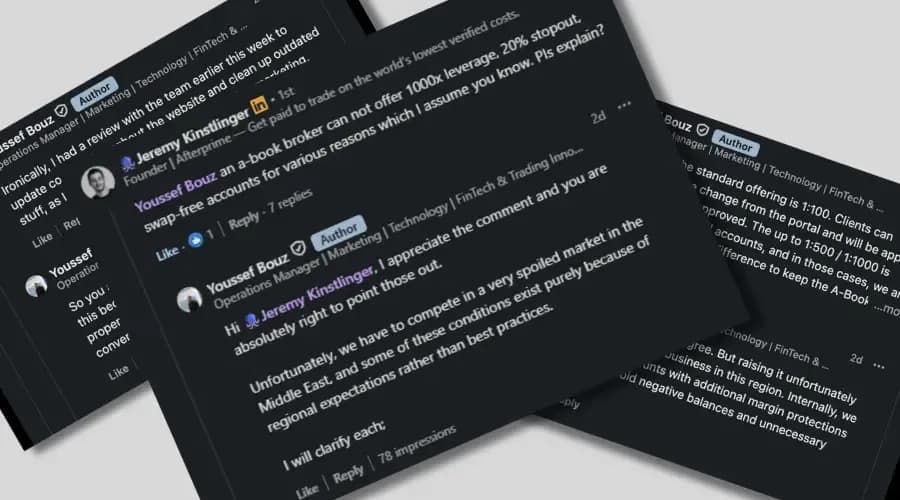

This article was inspired by a recent exchange I had with Jeremy Kinstlinger , a well-known advocate for transparency, integrity, and true A-Book brokerage models. Jeremy has spent years pushing for cleaner, more honest standards in our industry.

He left a direct comment under my recent LinkedIn post, questioning whether certain aggressive trading conditions (1000:1 leverage, swap-free periods, low stop-out levels) can realistically exist alongside a genuine A-Book execution model.

In parallel, we continued the discussion privately. In our DM conversation, Jeremy clarified his viewpoint, shared experiences from his own brokerage journey, and encouraged me to address this topic openly — with the greenlight to reference him and include our exchange.

His message wasn’t criticism — it was a reminder. A reminder of a truth we rarely say out loud:

The market is spoiled.

The expectations are unrealistic.

And honest brokers are forced to compete against fantasy.

So this article is my sincere response — not just to Jeremy, but to every trader, IB, partner, and peer trying to navigate a market distorted by offers and conditions that have nothing to do with real liquidity, real trading, or real brokerage economics.

1. A Market Polluted with Unsustainable Promises

For years, the FX/CFD space, in general, and especially in the Middle East — has been shaped by offers that simply do not reflect real market structure:

Unrealistic leverage

2000:1, 3000:1, “unlimited.” Attractive on paper, but that’s it. No risk management logic behind it.

Unrealistic spreads

Spreads tighter than what any institutional liquidity provider streams. Heavily manufactured, often manipulated.

Unrealistic rebates & commissions

IBs receiving payouts that exceed what the broker earns from its LP. Mathematically impossible without B-Book exposure.

Unrealistic compensation structures

Rewarding:

net deposits

net inflows

profit shares disconnected from performance

bonus schemes designed for churn, not sustainability

Unrealistic long-term swap-free

Offered without hedging, without coverage, without transparency.

This is the environment traders and partners are exposed to from day one. These unrealistic offers become the benchmark, and the moment you offer real conditions, you appear “less competitive,” even though you’re the one protecting clients, not exploiting them.

Good brokers get punished for being real.

Bad brokers get rewarded for selling dreams.

2. The Client’s Dilemma: Confusion, Paralysis, and Mistrust

Modern traders jump from broker to broker searching for:

tighter spreads

higher leverage

bigger bonuses

lower commissions

“more swap-free”

bigger IB rebates

better conditions

We can’t blame them. The market taught them to prioritize attractive offers over actual safety.

Between:

misleading marketing,

manipulated trading conditions,

Telegram “experts,”

comparison sites that are paid to rank brokers,and a sea of conflicting information…

The average trader lives in constant doubt.

3. The IB Reality: Endless Pressure, Endless Demands

Our Business Development team suffers the same requests every day:

“Match this rebate.”

“Broker X gives 0.0 spreads.”

“Broker Y pays on net deposits.”

“I want swap-free with no restrictions.”

“Give me $20 per lot on everything.”

“Match this bonus.”

Most requests are born from

misinformation or unrealistic expectations

created by brokers who operate far from real market structure.

But very few IBs initially understand the real value of a true A-Book model:

no conflict of interest

real institutional execution

long-term sustainability

risk transparency

real liquidity

real pricing

a broker that does not profit from client losses

In reality, we spend more time educating than negotiating.

4. How Much We Educate, Explain, and Protect

At GCC Brokers, we discuss these topics constantly. Not just with new clients,

but with long-term traders, institutional partners, IBs, friends, and the people who have been with us since day one.

We take the time to explain:

why leverage must be dynamic

why swaps exist

why spreads cannot be artificially compressed

why realistic rebates matter

why bonuses are not “free money”

why real liquidity protects them

why true A-Book matters more than any short-term offer

We do this because we care about building

informed, long-term relationships

, not chasing short-term gains.

And we are genuinely grateful when we meet an IB or partner who already understands these realities.

But here’s the sad truth:

The ones who understand…

usually understand because they’ve been burned elsewhere.

They trusted the wrong broker.

They got trapped by unrealistic conditions.

They learned the hard way.

It's human nature. Sometimes we refuse to learn, until we get hit.

And when someone comes to us after being misled, they finally appreciate the value of a broker that is aligned with their success (not their losses).

5. Staying Honest in a Market Full of Illusions

Running a real A-Book model means:

real spreads

real execution

real slippage

real swaps

real commissions

real exposure

real risk management

real liquidity costs

real transparency

That also means:

❌ No unlimited leverage

❌ No manufactured spreads

❌ No toxic bonuses

❌ No deposit-based commissions

❌ No unhedged swap-free

❌ No “fake STP” claims

❌ No back-end manipulation

Shortcuts always collapse.

And when they collapse,

clients pay the price.

6. Why This Conversation Matters

What happened on LinkedIn is exactly what the industry needs more of:

Open, honest conversations about what is real and what is not.

We didn’t take Jeremy’s comment as criticism. We took it as an opportunity to highlight issues most traders never see, and most brokers avoid discussing publicly.

7. The Future: Regulation, Maturity, and Transparency

The industry is evolving. Fast.

Clients are becoming smarter.

Regulators are tightening.

LPs demand transparency.

Fake brokers are getting filtered out.

Sustainability is becoming a requirement.